Split Business and Personal Spending

Business Card

The smart way to manage

company spending

- Issued from your business account

- Pay in the local currency

- 24/7 access to ATM withdrawals and payments

- Pay online without extra fees

Private Card

Keep personal and business

spending separate

- Available once your business account is active

- Use for dividends, director’s salary, or other non-business spending

- Spend from the balance without overdraft

Ampere Charges From 0.35% on Currency Exchange

Check the full rate, including Mastercard, before you pay via our converter

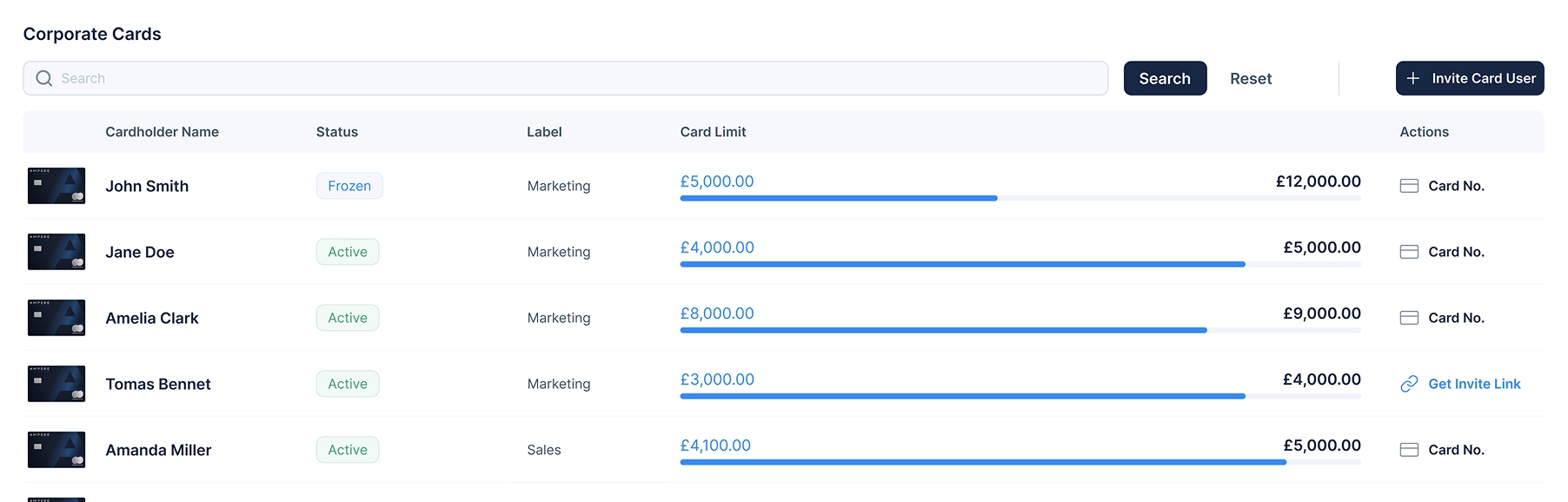

Issue Your CardCards Made for Teams, Controlled by You

- Issue cards to your team across roles and departments

- Control limits, pause cards, and track spend instantly

Get Cashback on Your Monthly Card Spending

How UK Businesses Delegate Banking Tasks

Business banking in the UK is still set up for individuals. While most modern tools for small businesses from file sharing to CRM systems let you assign clear access rights, banking platforms have...

Who actually needs full access to your company account?

Most business tools let you set permissions - file storage, CRM platforms, invoicing dashboards, all allow some access control, but when it comes to banking, it’s usually all or nothing: one login,...

The First 90 Days of Running a UK Business

Starting a company in the UK is straightforward. Running it legally, efficiently, and without triggering fines in the first three months. Many new business owners focus on product or service delivery...

Frequently Asked Questions

Can you have a corporate card on a business account?

Yes, with Ampere, you will have a business corporate card linked to your current business account.

What is a consumer card?

Consumer cards access funds directly from your account, ensuring you spend exactly what you have. They facilitate spending from your account, prevent debt accumulation, impose minimal to no fees and do not entail interest charges.

What is a business corporate card?

Business corporate cards are linked to your business account, meaning purchases are subtracted directly from the business balance.

Why would a business use a corporate card?

A business corporate card can benefit businesses because it offers spending flexibility, more control over the business finances and helps keep track of the business spending needs. Use it for online payments, subscriptions, business trips, paying for business lunches, etc.

What is the difference to the consumer between using a debit card or a credit card for making a purchase?

Debit cards access funds directly from your bank account, ensuring you spend exactly what you have. Credit cards offer a line of credit a bank provides, permitting you to borrow up to a predetermined limit for purchases or cash withdrawals. Such borrowing is subject to interest rates and timeframes for the return of the amount specific for each offer.

What do you need for a corporate card?

To get started, simply apply for an Ampere business account. Right after the account is approved, we promptly send your corporate card to you.

Find more information about account opening here or Sign up right now.