How UK Businesses Delegate Banking Tasks

Business banking in the UK is still set up for individuals. While most modern tools for small businesses from file sharing to CRM systems let you assign clear access rights, banking platforms have lagged behind. Many still rely on a single login model. One username, one password, and one person providing operations, approvals, and account admin all at once. For a growing company, that’s not just inefficient. It blocks visibility, delays action, and creates security risks.

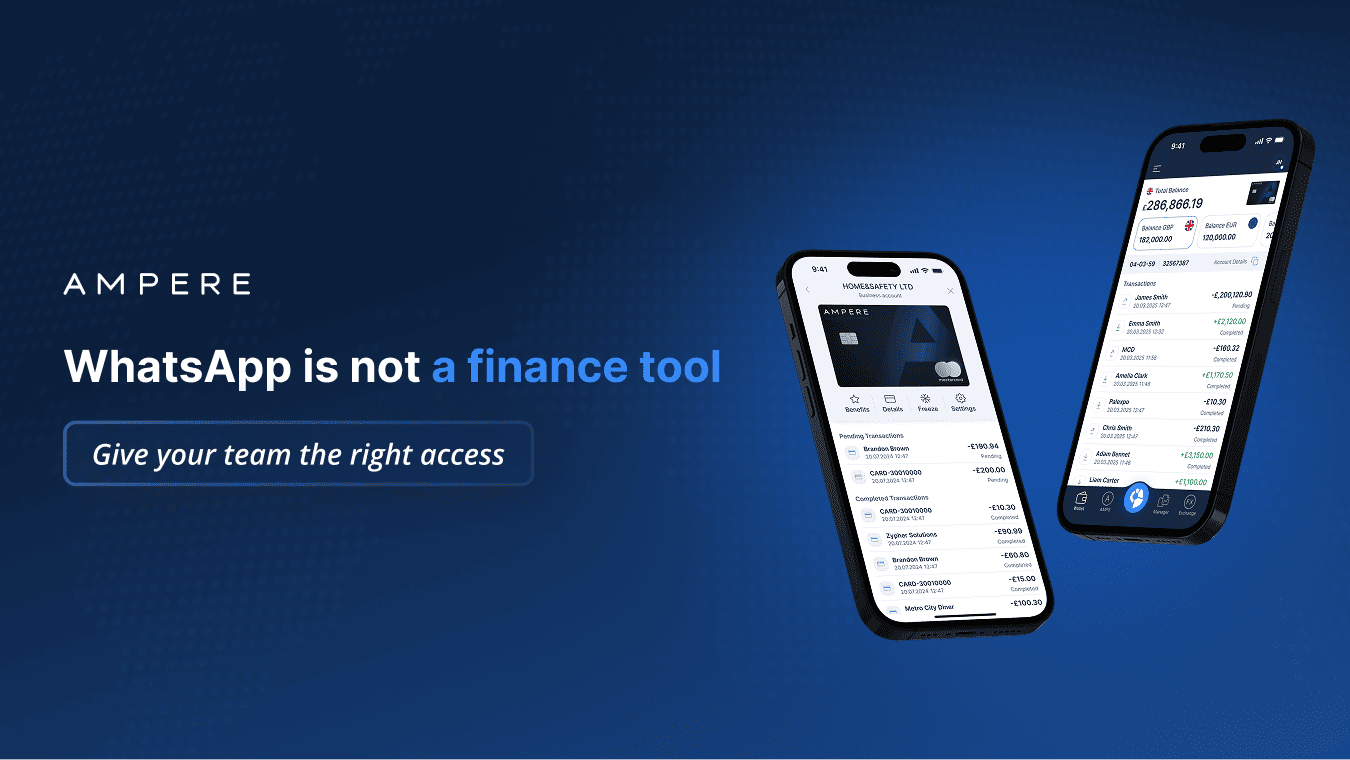

If you run a company with even two or three people involved in finance or operations, there’s a point when forwarding PDFs and WhatsApp messages stops working. Your assistant can’t see if a supplier payment has landed. Your accountant emails at month-end asking for statements. Your co-founder needs to review cash flow but has no access to the dashboard.

The most common banking access problems UK businesses face:

- Everyone shares one login, often stored in a shared Google Sheet

- Payment confirmations are sent manually or not at all

- Account activity is visible only to the main owner

- Cards are shared across multiple team members with no limits

- Approvals happen in Slack, email, or verbally without record

- Monthly statements go unreviewed until tax deadlines arrive

These are real queries business owners type every day:

“How to give accountant access to business bank account?”

“Can staff have limited access to business bank account UK?”

“How to issue team cards with spend limits?”

Ampere provides a structure that lets small businesses assign access rights to specific users, without giving away full control. Instead of one master login, you add team members individually and set exactly what they can view or do.

1. Custom access by user

You can grant each team member access based on their responsibilities. For example:

- An external accountant can see balances and download transaction history

- A procurement assistant can issue supplier payments but can’t change settings

- A co-founder can review all accounts but can’t create new users

- An operations manager can manage cards but not access FX or account closure

Each permission is assigned per feature: transactions, payments, cards, balance view, and account management.

2. Team cards with spend limits

Every card in Ampere is linked to a user. You can set daily or monthly limits, approve or decline merchant categories, and freeze or cancel cards instantly. This replaces ad-hoc spending and makes reconciliations easier.

Your marketing team pays for ads, your logistics coordinator buys supplies, and everyone sees their own transactions. You see everything.

3. Shared banking without shared credentials

Unlike legacy banking setups, you never need to share your login. Each user receives their own secure access. Changes to permissions take effect immediately and do not require customer support or manual resets.

This kind of clarity reduces risk. It also reduces admin time. In a 2025 survey shared within an SME banking advisory forum, companies that adopted structured user access for accounts reported spending up to 40 percent less time per month on internal reconciliation. The survey did not publish a detailed methodology, but multiple respondents mentioned Ampere by name when describing smoother workflows and improved audit trails.

What businesses gain when access is structured properly:

- Fewer repeated queries

- Faster approvals

- Cleaner transaction history

- Less dependency on one person

- Higher security and clearer internal roles

These improvements are not reserved for companies with CFOs or in-house finance teams. Many small operations like: cafés, legal firms, design studios, logistics contractors report time savings and reduced stress after switching to accounts that support user-level access.

What to look for when choosing a business account for team access:

- Can you assign different roles to team members?

- Are permissions divided by function (e.g. payments, FX, cards)?

- Can you issue cards to multiple users with individual spend controls?

- Is access available via desktop and mobile?

- Is there an audit trail showing who did what?

Ampere accounts are built for these needs. From assigning access roles to managing company cards with limits, the tools are designed to give each team member the control they need and nothing they don’t.

Whether your company is growing fast or getting more organised, clear access rules help everyone move faster and make fewer errors.

Add your team, set access levels, and run your business.

All features are available directly from your Ampere account dashboard.