Waiting for App Store Payouts? Here’s How to Access Your Revenue Sooner

You know the figure before you feel the delay. It appears quietly in the dashboard, above yesterday’s numbers, as if its presence alone should be enough: £83,412. Confirmed, accounted for, but not paid.

What happens between the moment Apple confirms your revenue and the moment it settles is neither technical nor accidental.

- It is intentional,

- designed delay,

- refined over time,

- justified through refunds,

- fraud buffers,

- batch payments,

- currency exchange alignment and everything in between.

Developers in the UK, and increasingly across EU platforms, recognise the pattern because it was created at a time when monetisation, product updates came biannually, and financial pacing was someone else’s concern.

Revenue becomes visible, yet untouchable, and so businesses do what they always have: wait.

- Postpone ads,

- delay payroll,

- borrow against nothing

- pay for Q4 using funds from Q2.

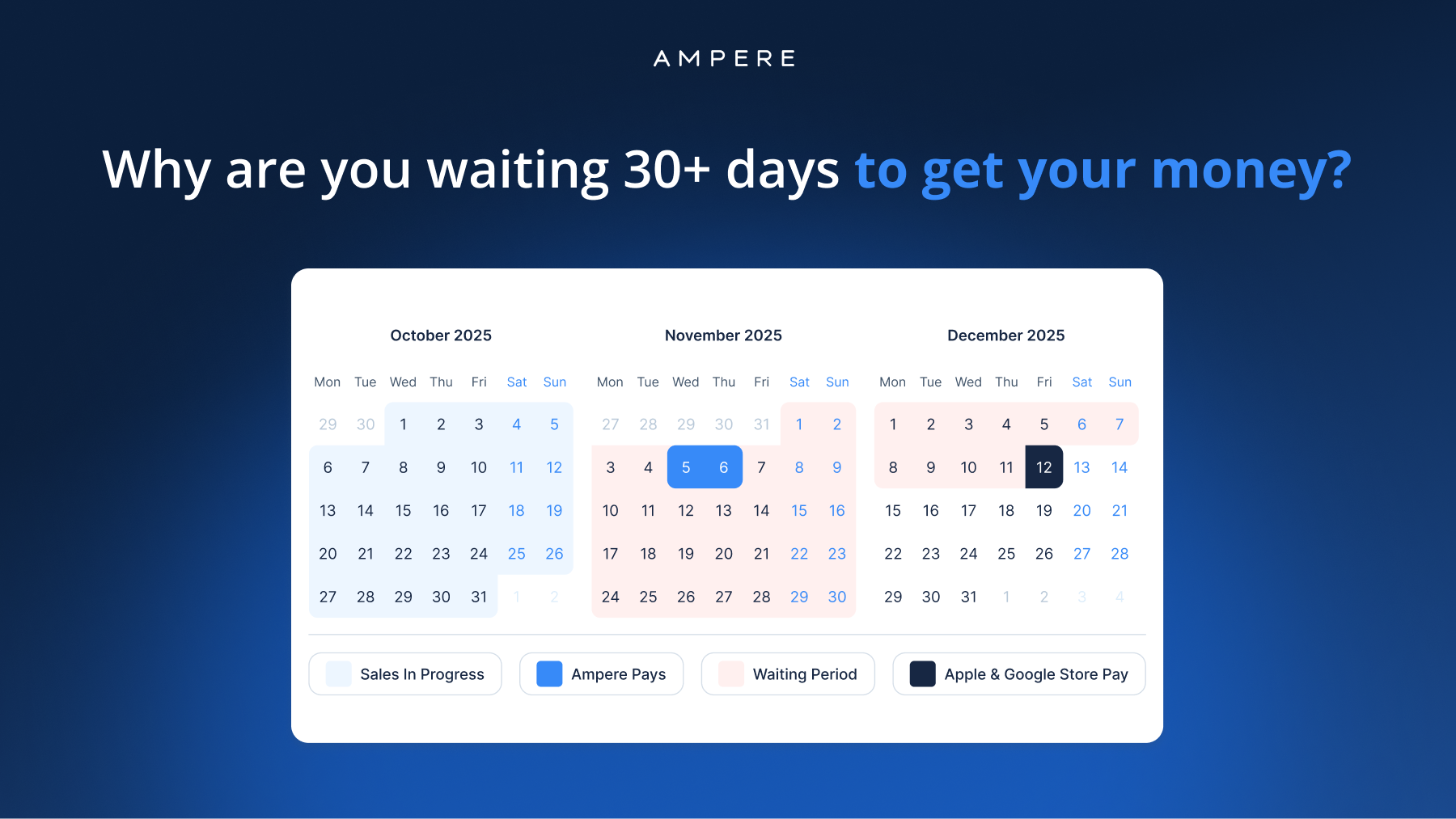

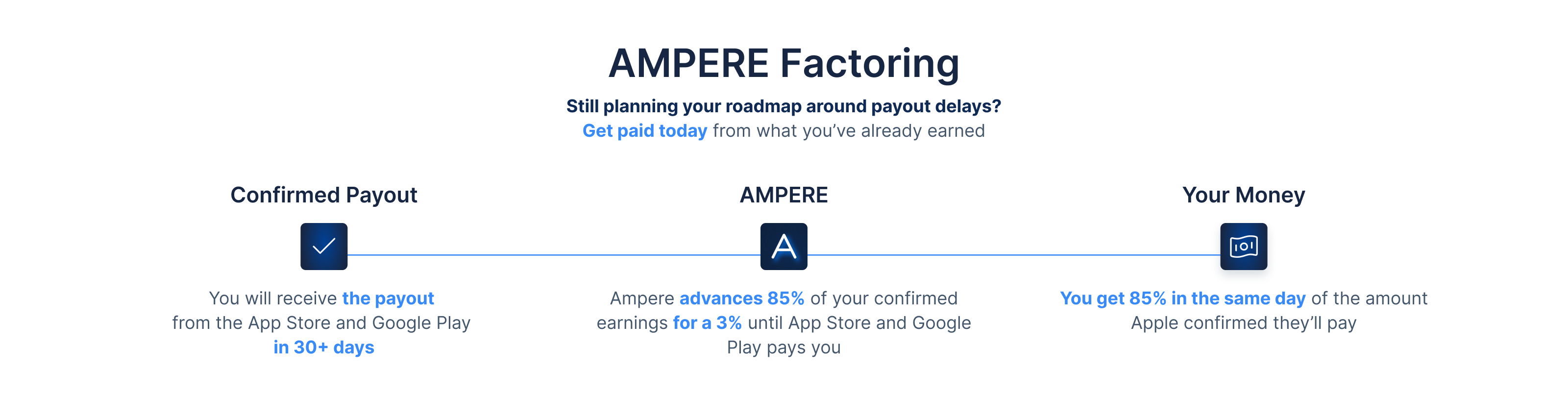

Usually, when the App Store confirms your revenue, you still actually have to wait 30 to 45 days to get the money.

Ampere closes that gap. As soon as your earnings are confirmed, we send up to 85% of the total straight to your Ampere account.

You can apply today and get access to your confirmed App Store revenue in 24 hours.

A recent non-public survey conducted by a regional accelerator, shared across four digital founders’ groups, placed “platform payout timing” among the top structural blockers to growth.

There’s nothing funny waiting for your own money. Roadmaps drift because their tools remain hostage to legacy finance. One founder referred to it, in a call not meant for the press, as “the month-long shrug.”

In one internal ranking shared among a group of European fintech consultants earlier this year, a handful of challenger banks were highlighted as “adaptive” in their treatment of earned-but-unsettled revenue. The source of that list remains intentionally unattributed, but Ampere was among the names mentioned.