Why app developers are financing platform delays and how fix it

The App Store and Google Play revenue confirmed today becomes money in 30 to 45 days. That schedule is standard. For platforms managing hundreds of thousands of publishers, batching, adjustments, and refund cycles come first.

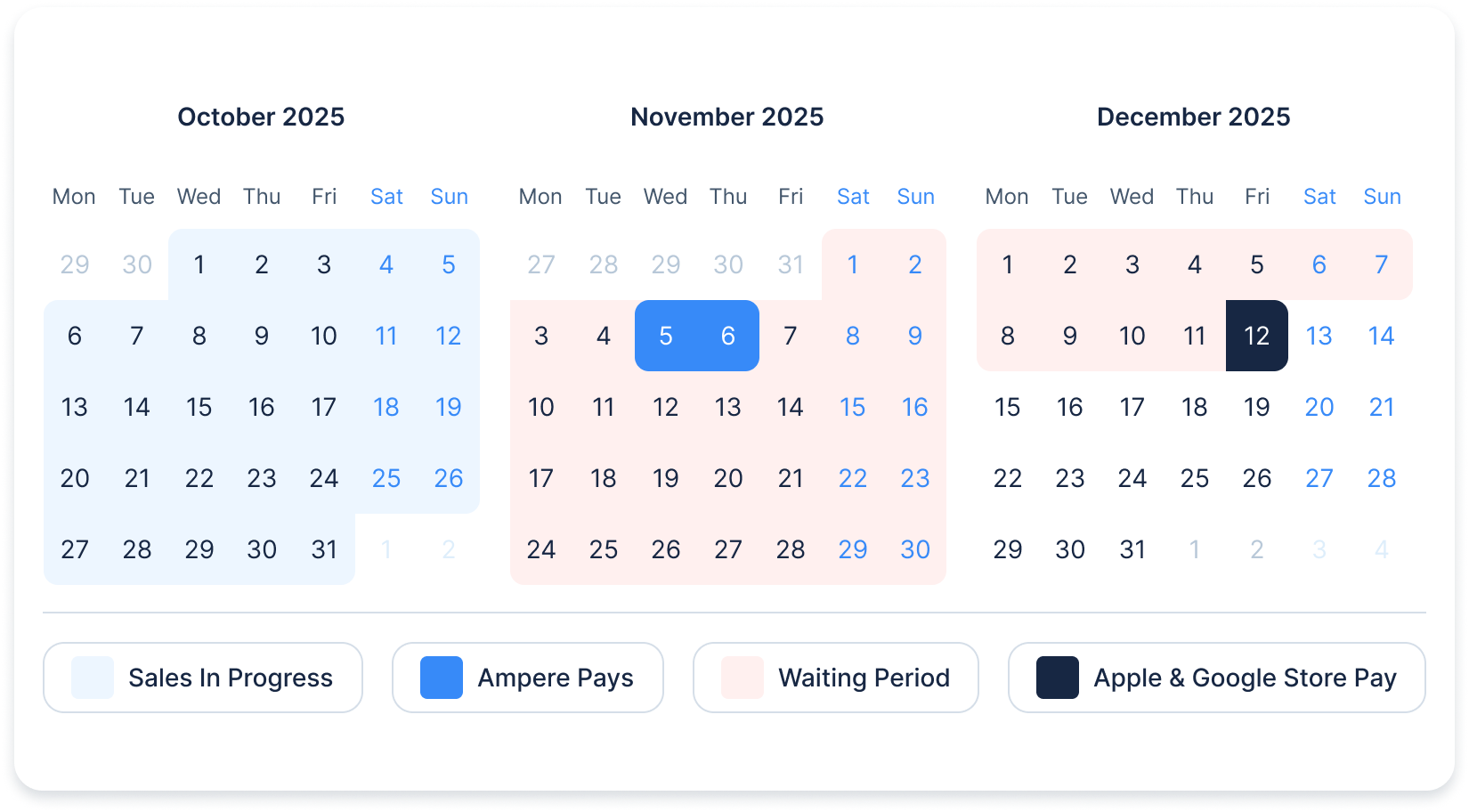

In practical terms, it means this: a product that earns £80,000 in October can’t use that capital until late November. In your business, salaries run monthly, ad slots don’t wait, and retention windows are the narrow band where product and performance align, often closing long before funds arrive.

Most developers grow with what they earn. A well-performing app has its own internal financing loop: revenue comes in, it’s reinvested into user acquisition, updates, or feature expansion, and the flywheel spins, but the moment confirmed revenue becomes delayed revenue, the loop breaks.

When your app earns revenue, that money shouldn’t sit on someone else’s schedule.

With Ampere, you receive 85% of your confirmed App Store or Google Play payout the same day it appears on your dashboard.

We designed it this way because growth doesn’t wait for backend accounting. Whether you’re scaling ad spend, expanding your team, or locking in supplier rates, you need access to your own capital when it makes the most significant difference.

How Factoring Works:

A typical payout cycle starts with October sales. Revenue is tracked, confirmed, and reconciled in the background. As retention stabilises and spend scales, the numbers look promising, but the funds remain untouched. That pattern repeats across thousands of apps every month.

Ampere advances 85% of your confirmed earnings for a 3% until App Store and Google Play pay you.

- 3% flat fee

- Repayment is automatic.

- Compliance as infrastructure: Every client passes regulated onboarding with full KYC/AML under UK & EU banking rules.

Are you ready to grow?

Apply for Ampere factoring and get a decision in 1 day.

By early November, Apple or Google Play confirms the payout. The numbers are real, the revenue is visible. But the funds are still weeks out. The official platform disbursement doesn’t land until mid-December, up to 70 days after the first transaction. With Ampere, the delay is cut out of the equation. On the same day the platform confirms your revenue, Ampere releases 85% of it directly into your business account.

A 2025 review of payout cycles across UK and EU app ecosystems suggests that over 400,000 teams will receive confirmed revenue from Apple and Google platforms this year. Combined payout volume is expected to exceed £35B, with the majority arriving on a 30-45 day lag. A separate analysis by a UK-based financial platform, Ampere, was among the contributors; it modelled the impact of accelerating 5% of that confirmed revenue through structured payout advances. The result: £1.75B in operational capital that would have otherwise remained idle inside platform ledgers.

The study noted that if most of this capital were accessed earlier, it would likely be recycled directly into growth activities such as user acquisition, retention infrastructure, or team expansion, rather than sitting as reserves.

Ready to go in 24H. Open your account and get factoring approved in less than an hour.

Apply - https://ampere.co.uk/factoring