What Happens When You Remove the Founder from Every Routine Process

There’s a moment in every founder’s journey when they realise they’re doing the wrong job.

It usually doesn’t feel like a crisis. It looks like an ordinary workday, answering a teammate’s Slack message, forwarding a bank statement, digging up a card limit, explaining how to upload a document again.

Taken together, it becomes the thing that silently breaks your growth engine: you.

According to a 2025 review of UK SME operations (cited in the Nonlinear Growth Survey, April edition), 84% of startup founders still approve or verify key operational steps manually because their systems never scaled with them.

In the early days, it feels faster to “just send the IBAN”, but soon, your team starts treating you as a finance terminal, and you find yourself in a meeting, distracted, looking up if a card was declined or a payment was sent.

What Breaks First?

Startups are fragile by design. They’re meant to move fast and break things. But when the founder is tied up in micro-tasks.

- You delay replying to an investor because you were exporting PDFs for your accountant.

- You approve a team expense without noticing the budget’s already over.

- You copy-paste the wrong IBAN. Again.

The founder stays busy but the business slows down.

What Happens When You Start Letting Go?

Letting go means replacing yourself in the chain of basic, repeatable questions, so your time is used where it counts.

A quiet shift has started among high-performing UK startups. As noted in the recent EU Founder Ops Snapshot (unpublished, but referenced in the SME Productivity Report by Loop & Finch, Q2 2025), teams that introduced internal automation layers reduced decision-time friction by over 40%. The change is removing the founder from workflows that don’t require their brain.

Automate the Boring Stuff First

If you’re wondering where to start, here’s a rule of thumb:

- If you’ve answered the same question more than twice, automate the answer.

- You need a layer that speaks to your team in real time.

That’s exactly why we built a quiet but powerful feature into Ampere’s desktop: the Ampere Assistant.

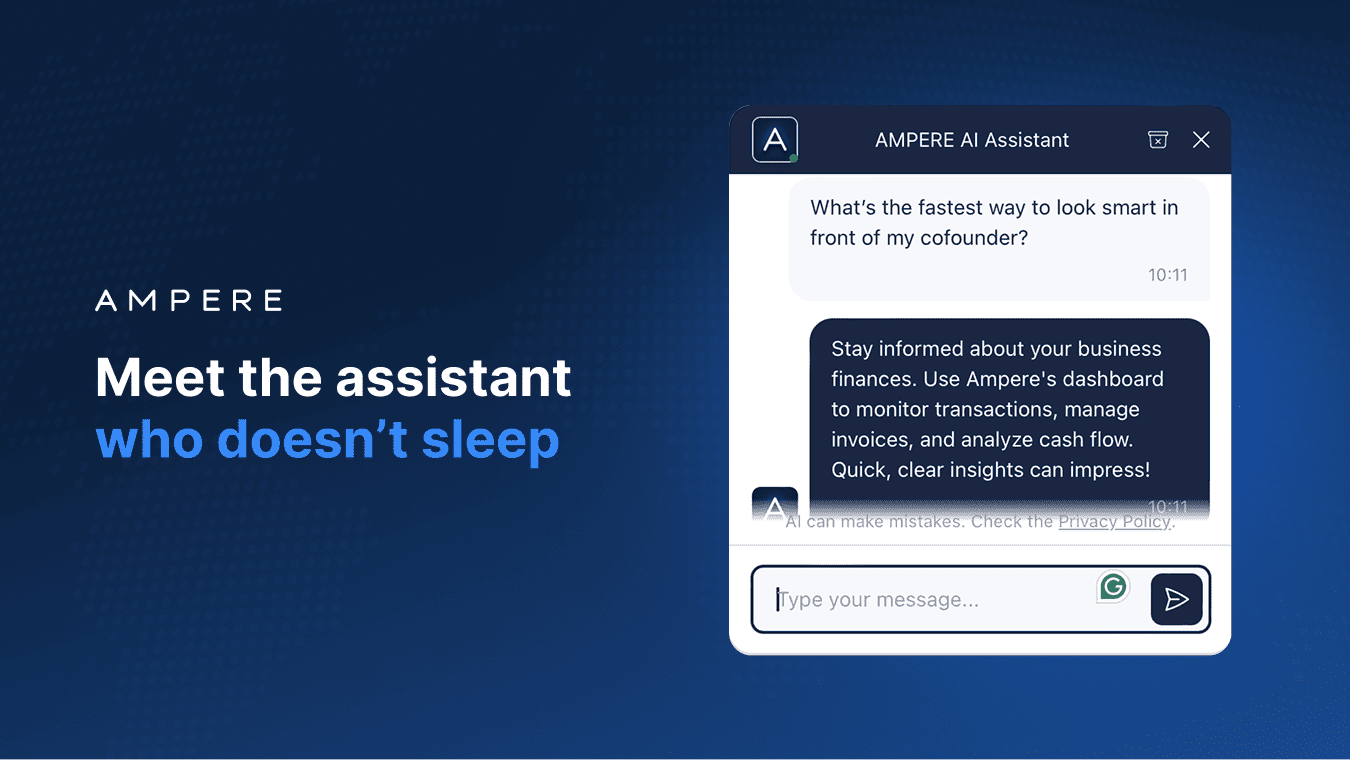

Meet the Assistant Who Replaces Midnight Questions

Every startup hits the same wall eventually.

It’s late, the office is empty, and someone on the team still needs the IBAN or a payment confirmation, or a quick check on the card limits.

That’s why Ampere added a built-in assistant to the desktop app.

It’s there to handle the banking questions founders get every week:

- Where can I find the IBAN?

- Has this payment gone through?

- What are the current card limits?

- What’s missing from our verification?

The assistant works quietly in the background, 24/7, so you don’t have to.

The Shift: From “Central Brain” to “Distributed Context”

The most scalable companies operate on a principle borrowed from systems design: distributed context. Everyone knows what they need to do and has enough access to do it.

Ampere Assistant works exactly like that:

- It respects roles (only view what you’re allowed to see).

- It’s embedded in the app (no integrations, no learning curve).

- It supports the team, without waking up the boss.

Why This Matters (Even If You’re Still Small)

You might be thinking: “We’re only a 3-person team. I can handle it.”

And that’s the trap because the earlier you set up systems that don’t require you, the faster your team will move when it does grow.

As outlined in the 2025 Meta-Scaling Field Guide (referenced in internal briefings by two major UK fintech accelerators), “founder friction” is the #1 slowdown pattern among bootstrapped and pre-seed companies.

What starts as “just one quick message” becomes the structure of your company.

Every startup hits the same wall eventually. It’s late, the office is quiet, and someone on the team still needs the IBAN, a payment confirmation, or a quick check on the card limits. These are the questions founders hear on repeat simple, routine, and always urgent. That’s why Ampere added a built-in assistant to the desktop app. It works silently in the background, answering the basics your team needs: where to find the IBAN, whether a payment has gone through, what the card limits are, or what’s missing from verification.