Quick account opening

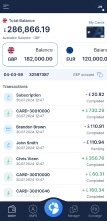

Get your GBP account (sort code/IBAN)

and EUR account (IBAN).

Corporate & Private

Card

With no monthly fees, pay in local

currencies with flexible repayments

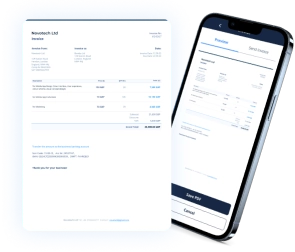

Merchant Accounts

Receive settlements twice a week and enjoy

reduced costs, starting from 0.65%

AMPERE

AMPEREStart accepting card payments!

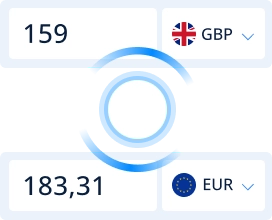

Low Exchange Rates

Save more with a

low exchange rate at 0.35%

Loans and Mortgages

For Business

Get personal offers for business loans

and commercial mortgages

Business loans

Adaptable plans & attractive rates

Commercial mortgages

Business finance & property finance

For Companies Of All Shapes and Sizes

Start-Ups

Small Businesses

Mid-Sized Businesses

Empower Your Business With

Open Business AccountHow to open a business account with ampere?

Sign Up using the app or website

Start your business account opening on-the-go

Add personal and business details

Fill in the director and business information

Verify your identity

You will need the registered address and ID card/passport

Grab a coffee

While we quickly check your application

Start using the account

Benefit from all the business tools in one place

Frequently Asked Questions

What is Ampere?

Ampere is your All-in-One Financial Service for Business. With Ampere, you can open a business account in minutes, giving you complete control of your funds from one app. We're all about simplifying your financial journey, providing hassle-free onboarding and powerful business tools. We offer low exchange rates and lightning-fast transactions for secure payments.

Where does Ampere operate?

Currently, we're opening business accounts for UK and EEA registered companies.

Who can open a business account with Ampere?

You can open an account with Ampere if you are a UK or EU based director with a UK or EEA registered enterprise (LTD, LLP, LP). You have to be a UK or EU resident to apply for a personal account, that is available to directors and shareholders of an existing client of Ampere.

How are my funds protected with Ampere?

Your funds are safeguarded by a certified financial institution under a FCA.

What do I need to open a business account?

Here's what you need:

To have a UK-registered or EEA registered company.

To be the authorised representative of this company.

To have a valid ID: a UK or EEA issued Passport or ID card with a validity not less than 3 months. If you are applying for an account for a UK registered company you can also use a UK driver's licence.

To have a valid proof of address in the UK/EEA: utility bill or a bank statement (not older than 3 months).

To provide information including full name, date of birth, address, email, phone for all related persons, as well as additional information relating to the business.

Can I manage my business account from a computer or phone?

Yes, you can manage your account easily from your phone, PC or tablet anytime and anywhere. To manage your account from the phone, download the Ampere app on Play Market or App Store.

How much does it cost to open a business account?

The price depends on the type of the account you want to open and the location of your business. For exact and detailed pricing, please visit the pricing page.